What’s In a Long-Term Disability Insurance Quote?

Posted 8/31/2011

_

Insurance in general is one of those tricky things that is easy to try and “shop” or “price-out” with multiple carriers. One of the hazards in doing this can be that quotes are generally given in the most price-favorable rating, and without all of the possible features you might want in your policy. Since the goal is to give the cheapest quote possible, insurance is typically quoted at the highest/healthiest rating available. This may or may not be your rating. Your rating can only be determined after full medical health underwriting (medical exam + medical records search).

_

Long-term disability insurance quotes are even more dangerous than life insurance quotes. Life insurance is pretty black and white when it comes to filing a claim, you are either dead or you’re not. Disability insurance can be debated on whether you meet the contract definitions to qulaify for a paid claim. You may or may not be considered disabled based in the definitions in the contract that your choose.

_

Below is an example of a long-term disability insurance quote on a 26yr old male dental resident. A quote can be anywhere from a “Bare-Bones” policy with just a base policy to a “Cadillac” policy with a lot of additional important features.

_

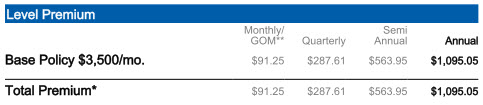

A “Bare-Bones” quote would look like:

_

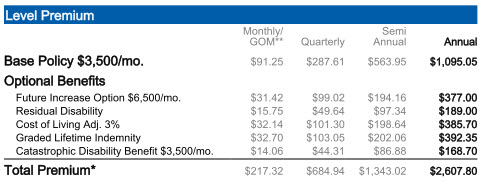

A “Cadillac” quote would look like:

_

Once again, it is very important to consider the strength of the language in the long-term disability insurance contract as well as the financial strength of the carrier when comparing quotes. Use an insurance professional who is objective and can sell all of the carriers’ disability contracts. Don’t rely on cheap quotes. Quotes come a dime a dozen. Good advice can be hard to find. And remember, you will usually get what you pay for. Hopefully this helps.

Leave a Reply