Application Process

Best Disability Insurance

Application Process

_

The application process for disability insurance can range from 4 weeks to 3 months, typically 6-8 weeks should be expected.

_

Applying for disability insurance with a company does not obligate you to buy their policy. When applying, you are are trying (1) to see if you can get an OFFER or APPROVAL from the company. If so, (2) what would be the COST or PREMIUM for that policy?

_

The process can be related to applying for school. When applying for school, you can apply to multiple schools and all you are trying to find out is, (1) will they accept you? (OFFER), and (2) what is the cost of tuition? (PREMIUM) Then, you can either decide to accept their offer and begin paying tuition, or you can decide you don’t want to attend their school and look at the next best school.

_

5-Step Process of the Application/Underwriting Process:

_

1. Application: Filling out paperwork to apply for insurance initiates the process with an insurance company. It consists of answering some general questions, as well as medical questions, along with some signature pages to authorize things like release of medical information to the insurance company, testing your blood, and getting access to your medical records from your doctors. GET STARTED!

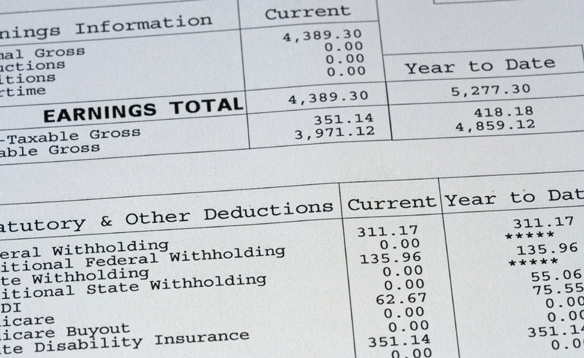

2. Provide Financial Proof of Income: This usually requires documentation such as tax returns, recent paycheck copies or pay-stubs, or signed employment/compensation contracts to be submitted to the insurance company along with the application.

3. Medical Exam: Sometimes referred to as a Paramedical Exam, this is a personal interview with you to collect information about your medical history. The information allows the insurance company to perform a comprehensive evaluation of your current health. The exam usually includes recording your height, weight, blood pressure and pulse. The exam may also include the collection of blood, urine, oral fluid, and an EKG depending on the insurance company’s underwriting guidelines based on your age and amount of coverage.

Recommendation: It is strongly recommended that this exam be scheduled early in the morning before the stresses of the day can begin. Your vital signs are usually at their best right after you wake up from a good night’s sleep, your heart rate and blood pressure are at a resting level, no caffeine in your system yet. Be sure to eat healthy the night before, drink plenty of water, and don’t do any strenuous exercise or activity at least 24 hours before your exam.

4. Medical Records Research: This is usually the lengthiest part of the whole process, mostly due to physicians’ offices taking their sweet time (they have up to 30 days to comply by law). Providing full contact information for all physicians in the Application can speed up the search. You may be asked to contact the physicians to release your medical records to the insurance company to get them moving.

5. The Decision/Offer: Once all of your medical records are received by the underwriter of the insurance company, they will begin to assess your insurability by looking for any red flags. These include major medical concerns, or potentially disabling medical conditions or impairments. Most pre-existing conditions that can be found in your medical records can be “excluded” from coverage on a policy. Exclusions are not always terrible things – they allow the insurance company to still offer you a great-quality policy while just excluding particular things. Also, in some cases, exclusions can be considered for removal after a certain number of years as a policyholder with no reported issues. Once a decision is reached, an offer is made to the applicant. The applicant can either accept the offer and put the policy “in-force” by paying a premium, or reject the offer.